7/28/2025

Planned giving is an act of faith and good stewardship

by Rev. Erin Dunigan

Editor’s note: This information is for educational purposes only. We recommend that you consult with legal and financial professionals regarding your particular needs and circumstances as you make your legacy plan.

How will your story continue after you’re gone? How can the values you hold dear, the faith that guides you, and the generosity you practice today ripple out to bless future generations?

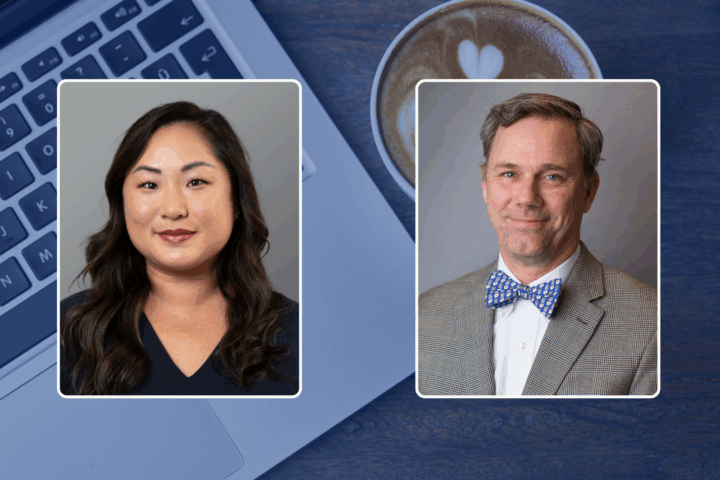

At a recent Presbyterian Foundation Day of Learning, Rev. Sandra Moon, Ministry Relations Officer, and Karl Mattison, Vice President of Planned Giving Resources, explored how we can leverage storytelling in planned giving to inspire a lasting legacy, ensuring ministry thrives for years to come.

Your Legacy, Your Story

Rev. Sandra Moon began with her own story. “I was born in Toledo, Ohio to first generation Korean Americans,” she shared. Her grandmother lived in Korea, but would often come to visit and then came to live with them.

“When I would wake up in the morning,” Sandra recalled, “I’d see her reading the Bible and praying. Even with our language challenges, I knew she was praying for us.”

When her grandmother’s health failed, she returned to Korea to die in her homeland. Upon her death, she left a small inheritance to her children and a special gift to her home church in Seoul: a new set of pew Bibles. “Considering that my grandmother attended one of the largest Presbyterian churches not only in Korea, but in the world, this was a significant gift,” Sandra shared. “In life and death we belong to God, and I’m so grateful for my grandmother’s legacy.”

This is the heart of planned giving. It’s about weaving together your values, your faith, and your generosity into a lasting story.

What is a legacy?

Legacy is more than money. It’s the intangible-yet-powerful effect of a life lived with purpose. It’s the stories, values, recipes, and faith practices we pass down. As Deuteronomy 6 instructs, “Love the Lord your God with all your heart and with all your soul and with all your strength. These commandments that I give you today are to be on your hearts. Impress them on your children. Talk about them when you sit at home and when you walk along the road, when you lie down and when you get up.”

Legacy is woven into the very fabric of our faith as a call to remember, teach, and create a path for others to follow.

Karl Mattison, who came to planned giving after a career in banking, highlighted the profound difference. “There was no story sharing in banking,” he said. “But in planned giving, the story has turned into my very favorite part of any gift. I remember every single gift where I know their story. I get to continue saying their names and telling their story so that people they never met still understand their why.”

Where to Start

Many people intend to plan their legacy but hesitate, thinking they don’t have enough assets or that the process is too complicated. The starting point is simpler than you think and involves two key parts: passing down your values and your valuables.

Passing Down Your Values: The Ethical Will

An ethical will is not a legal document, but a personal one, Moon explained. It’s a letter or other recording you can use to pass down the intangibles:

- Core family stories and guiding principles

- Life lessons and spiritual values

- Advice, wisdom, and hopes for your family’s future

- The “why” behind decisions in your legal estate plan

In a world where we often don’t know the stories of our own parents and grandparents, an ethical will is a profound gift to your loved ones. This is your chance to share what you wish people would remember about you, Moon said. An ethical will is not an autobiography and should be limited in length. If you are inspired to share even more of your intangible assets with your loved ones, you can consider other ways to do so, such as writing a book.

Passing down your assets

Estate planning deals with the tangible elements of your legacy, Moon said. It is the preparation for the management and distribution of your assets upon your death or incapacitation. Far from being just a financial task, it is an act of faith and a gift to your loved ones, easing their burden during the challenges of managing your care and your assets as they are dealing with stress and mourning your loss.

Estate Planning Essentials for Every Adult

- Durable Power of Attorney: This legal document authorizes a person you trust to make financial and legal decisions on your behalf during your lifetime and can be limited to only taking effect upon incapacitation.

- Health Care Directive (or Living Will)/Designation of Health Care Surrogate: This document outlines your wishes for life-prolonging medical care and designates a healthcare proxy who is authorized to make decisions regarding your treatment if you are unable to do so yourself.

- Last Will and Testament: This is the cornerstone document where you name an executor to manage your estate and beneficiaries to receive your property. If you die without a legally executed will, state law will determine how your assets are distributed, regardless of any wishes you may have otherwise expressed. A will is also a document that allows you to nominate guardians and trustees for minor children.

A will should be reviewed every five years or after any major life event. As Karl noted, many of our most significant assets, such as retirement accounts and life insurance, are not controlled by a will but by beneficiary designations. This makes a comprehensive plan essential.

The power of a planned gift

In the United States the majority of a typical household’s assets are not in cash. They are in homes, retirement accounts, and investments. “One day we will all be finished with all of this,” Mattison said. “We have the opportunity to decide who uses these resources to continue on our story on our behalf.”

Here are common ways to make a planned gift to your church or other ministries:

- Bequest: A gift made through your will. It can be a specific amount or a percentage. If tithing is your practice, leaving 10% of your estate is a powerful final tithe.

- Retirement Plan Beneficiary: Naming your church as a beneficiary of your IRA can be highly tax-efficient. Heirs pay income tax on IRA distributions, but a church does not.

- Other Beneficiary Designations: Bank accounts, investment accounts, and life insurance policies can all have a charity named as a beneficiary, bypassing probate.

- Charitable Trusts: For those with higher net worth, a trust can provide you with income for life, offer significant tax benefits, and leave a large future gift to ministry.

- Donor-Advised Funds: This tool simplifies all your giving. You make a tax-deductible gift of cash or securities to a fund, and then advise the fund to make grants to your favorite charities over time.

Teach Others, Invite Stories

Planned giving is more relevant than we imagine. The peak years for making a first planned gift are the 40s, 50s, and 60s. Yet only 5% of Americans have a planned bequest, while studies show 28% would if asked.

The Presbyterian Foundation is here to help. Resources like the Center for Print Resources, Stewardship Navigator, and dedicated Ministry Relations Officers can help your congregation build a legacy giving program from the ground up.

The final, crucial step? Invite people to share their story. When someone informs you they have included the church in their estate plan, ask them to share a bit about their “why.” Then, keep telling that story. In doing so, you honor their legacy and inspire the next generation to create their own.